Introduction

Sia, Eva, Keya, Aha, Abhi…

No, you didn’t get accidentally redirected to a baby names site. Believe it or not these names have relevance in the banking sector. They are all names of chatbots that you will see while you are interacting with your favourite bank online. SIA stands for SBI Intelligent Assistant, Eva is the chatbot of HDFC Bank, Keya of Kotak Bank, Aha the virtual assistant of Axis Bank and ABHi, an interactive AI belonging to Andhra Bank.

According to a popular study, about 63% of the customers around the world look forward to personalised customer services while dealing with a financial sector organisation or a brand. A study published in Accenture Banking Technology Vision 2018 report stated that 83% of the bankers in India believed AI to sweep the group alongside humans in the two years after that.

Facts are right in front of us, but let’s jump into the basics!

No, you didn’t get accidentally redirected to a baby names site. Believe it or not these names have relevance in the banking sector. They are all names of chatbots that you will see while you are interacting with your favourite bank online. SIA stands for SBI Intelligent Assistant, Eva is the chatbot of HDFC Bank, Keya of Kotak Bank, Aha the virtual assistant of Axis Bank and ABHi, an interactive AI belonging to Andhra Bank.

According to a popular study, about 63% of the customers around the world look forward to personalised customer services while dealing with a financial sector organisation or a brand. A study published in Accenture Banking Technology Vision 2018 report stated that 83% of the bankers in India believed AI to sweep the group alongside humans in the two years after that.

Facts are right in front of us, but let’s jump into the basics!

What's the Deal with AI?

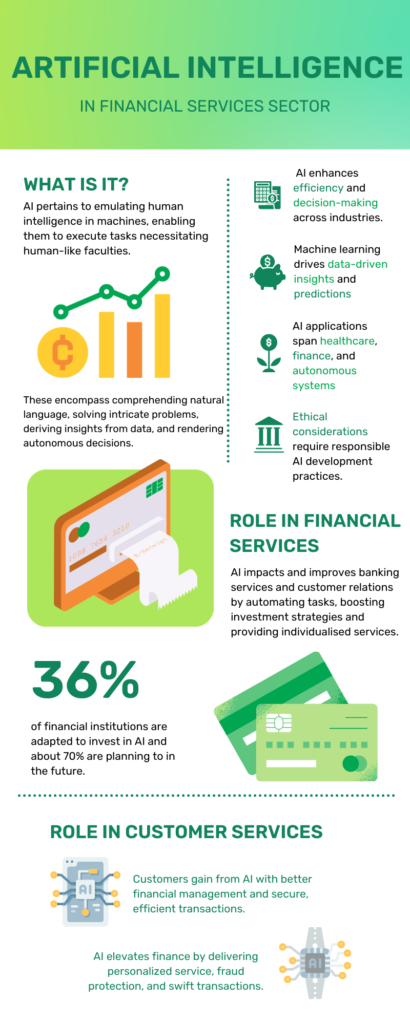

Chatbots and virtual assistants are but just one part of AI. In the financial services sector,

artificial intelligence has taken a long stride in every possible step. The buzzword AI has taken

over multiple trading, technological and other platforms. If you do not have a lot of time to spare,

stop scrolling and study this infographic:

How AI can be the Watchdog of Financial Sector

As complicated and vengeful as they portray AI to be in the movies, with the right

judicious mix, it can monitor the whole process of transactions and financial exchanges. With

moderated AI tools, the role of human resource and the intellect of the machine can be put to

use. Here are some ways AI is overtaking the security and safety part of the financial services:

- Efficient detection of fraudulent activities and risk analysis by spotting unusual patterns in the transaction data.

- AI-driven algorithms are employed by hedge funds and investment companies to make split-second betting choices based on market statistics.

- To cater to creating an individual’s investment portfolios, AI is being used, which analyses financial risks, goal assessment and time frame.

- Fintech firms like Upstart utilise AI to gauge creditworthiness by considering criteria other than traditional credit ratings, such as education and job history.

- AI systems can help in analysing vast datasets and anticipate market conditions and trends and hence to formulate investment strategies.

- Banks these days use AI-powered cybersecurity measures and tools to detect and respond to threats in real-time

Where Humans Can’t Reach AI Can

This is true not only in the case of AI advancements and technological reach, but also in the

ways through which AI is reaching customers and consumers, when the parent company or the

brand can’t. Developing an AI tool once and for all is cost-efficient in the long run and is

considerably the best practice in the coming age of the market. In financial markets, AI has multiple roles to play:

- Customers look for efficient and easy ways to engage with the financial organisations.

- They almost always would like their needs met by a patient receiver, who takes time to be with, and answer their queries in a judgement-free environment.

- After the Covid-19 pandemic, face-to-face skills and contacts are not considered a necessity, nor a mandate for business inflow.

- People are now more and more trusting automation and machine operations, rather than human involvement.

Conclusion

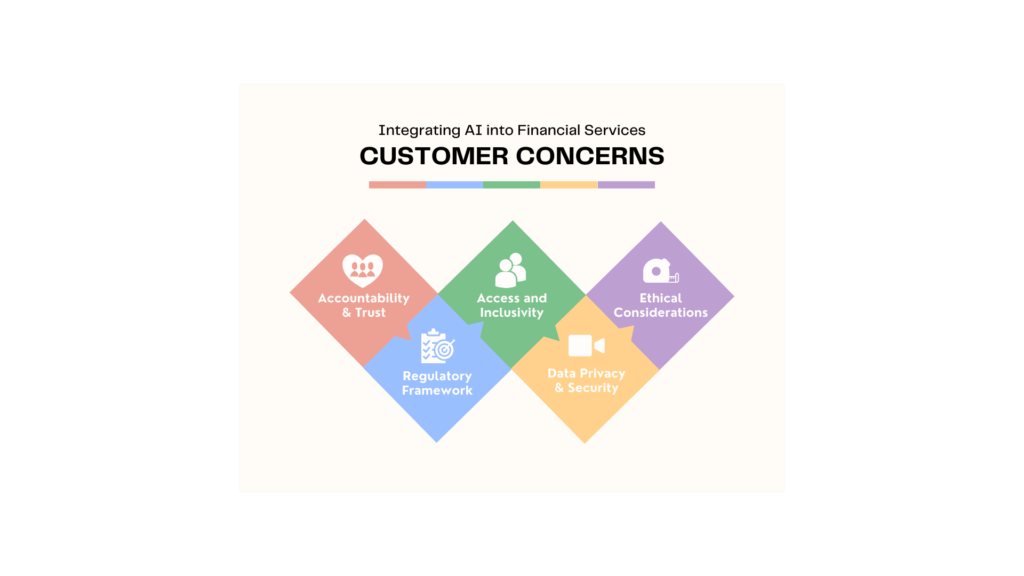

Concerns of embracing AI also linger in the mind of the common man. However, in the fast

pacing era, a more secure and unbiased means of carrying forward business is required. As long

as AI tools and machines are under surveillance, it can be a capital to businesses.

The Indian financial market, which has always been open to new ideas and feasible technological transformations, paired with the youth in the advancement field can bring wonders that can ease the tiresome process, red-tapism, long queues, corruption and data manipulation. It is anticipated that by 2035, the Indian economy can add approximately $1 trillion, if it were to tap the potential of AI.

Time of “Hema, Rekha, Jaya aur Sushma” is in the past; now is the time of Sia, Eva, Keya, and Aha!

The Indian financial market, which has always been open to new ideas and feasible technological transformations, paired with the youth in the advancement field can bring wonders that can ease the tiresome process, red-tapism, long queues, corruption and data manipulation. It is anticipated that by 2035, the Indian economy can add approximately $1 trillion, if it were to tap the potential of AI.

Time of “Hema, Rekha, Jaya aur Sushma” is in the past; now is the time of Sia, Eva, Keya, and Aha!